Good times set to roll at MB World

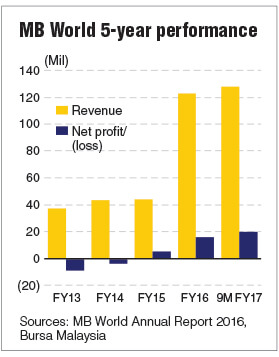

KUALA LUMPUR: MB World Group Bhd, whose net profit for 2017 more than tripled to RM16.41 million, sees the good times continuing. The Johor-based property developer is expecting earnings to grow at a much higher rate over the next two to three years with more launches to come.

“The take-up rate of our products at Taman Sri Penawar (township in Kota Tinggi, Johor) is doing very well, what with the ongoing development from the Desaru Coast and the refinery and petrochemical integrated development (Rapid) project in Pengerang,” MB World executive director Ng Liang Khiang told The Edge Financial Daily in an email interview.

The group plans to roll out two projects in Johor in the second half of this year. The first project comprises over 250 affordable homes with a gross development value (GDV) of RM14 million, while the second is a mixed development with a GDV of RM1.46 billion.

“We trust the sales will be just as encouraging, [but] the results will only be reflected in our financial year ending Dec 31, 2019 (FY19),” the 66-year-old Ng said.

For the cumulative nine months ended Sept 30, 2017 (9MFY17), MB World saw its net profit jump 2.4 times to RM19.61 million from RM8.07 million a year ago, while revenue grew 68.7% to RM127.79 million from RM75.74 million for 9MFY16.

Ng expects MB World to also benefit from the increasing connectivity and development of mega-rail projects such as the Kuala Lumpur-Singapore high-speed rail and the Johor-Singapore rapid transit system.

“Despite the current property glut in Johor, Iskandar Malaysia and Rapid will remain the catalysts for socio-economic growth in Johor,” Ng said, predicting that demand for residential housing will increase in due course on the back of the population projection by the Iskandar Regional Development Authority in its 2014-2025 development plan for the area.

The property developer in December last year signed a development right agreement with PIJ Property Development Sdn Bhd (PPDSB), a wholly-owned unit of PIJ Holdings Sdn Bhd, to develop 49.62 acres (20.1ha) in Telok Permata, Johor into an integrated waterfront development.

The development will include affordable housing on 15 acres under the Rumah Mampu Milik Johor initiative, as well as serviced apartments, affordable houses, townhouses, shop offices and a mall.

While MB World is keen on pursuing similar agreements to prevent having to make a significant cash outlay, Ng said the group is actively on the lookout to increase its land bank without limiting itself to Johor.

“There will be an increase in the group’s gearing ratio as we expand our property development division but it will still be manageable,” he said. The group’s gearing ratio currrently stands at 0.19 times.

As at Sept 30, 2017, MB World’s cash balance stood at RM13.97 million, while total borrowings were at RM44.19 million.

Formerly known as Emas Kiara Industries Bhd, the group is also divesting its geotechnical engineering services — once its core business — as the segment faces keen competition within its niche market as it has been incurring losses.

“Moving forward, we will fully focus on our property development and construction,” Ng said.

Hong Leong Investment Bank (HLIB) Research, which is currently the only research house with coverage on the stock, pointed out that MB World has previously been able to buck the lacklustre trend of the overall property market to achieve a more than 80% take-up rate within a year after the launch of its projects.

It is forecasting a 70% year-on-year increase in MB World’s full-year FY17 earnings to RM27 million.

With a total RM3.5 billion GDV to be developed over 10 years, HLIB Research analyst Lee Meng Horng estimated that MB World is likely to see a three-year compounded annual growth rate of 49% from 2016 to 2019.

In a note dated Jan 15, Lee said MB World is a proxy to Rapid’s growth as it has a first mover advantage in capturing the spillover effect of population growth from the Petroliam Nasional Bhd-led development.

Apart from being distant enough from the Pengerang and Rapid projects to keep residents safe from the effects of pollution, rental yields for the group’s developments are expected to range from 6% to 10% based on rental rates in the neighbouring township, he added.

HLIB Research has a “buy” recommendation on the stock with a target price of RM2.75 per share, indicating a 34% upside to last Friday’s closing price of RM2.05.

“There is a potential increase in dividend following the projected high earnings growth,” Lee said. No dividend was declared or paid in FY16, given that the group was anticipating the commencement of the development in Taman Sri Penawar, and was also pursuing further growth opportunities.

MB World is controlled by siblings and executive directors Simon Sim Yow Kung and Cindi Sim, who held a 51% stake in the group via Kim Feng Capital Sdn Bhd as at March 31, 2017.

Shares in MB World have moderated after hitting a record high of RM2.29 on Jan 10, gaining 61 sen or 39.1% in the past six months. The group now has a market capitalisation of RM322.62 million and is trading at eight times its FY17 earnings.

http://www.theedgemarkets.com/article/good-times-set-roll-mb-world